COUNTY TREASURER

Robin Shrake, Treasurer

Term: 2025-2028

1300 Sherman Street, Suite 107, Sturgis, SD 57785

605.347.5871

Office Hours: 8 a.m. to 4.30 p.m., Mon. - Fri.

Contact Form

Meade County Treasurer Robin Shrake is excited to announce that she has launched a new online portal to pay property taxes: Pay My Property Taxes Online

The site accepts credit or debit cards, PayPal, and “eCheck” using your banking information.

Payments made before 6 p.m. MST/MDST are processed on the next business day. Payments made outside of regular “open for business days”, such as weekends and holidays will be posted on the next "open for business day".

Payments may take five (5) business days before reflected on your property taxes account, through this web site.

Charges and Fees:

Interest and late fees are added to payments that are past due.

A fee of $40 will be charged on all returned payments. Additional fees may be charged if a payment is returned after the payment due date. (SDCL 54A-3-422).

NOTE: Enter credit card and bank numbers carefully, typos can result in a returned payment and returned payment charges, as well as interest on taxes that could not be posted by deadlines.

Gov Tech Services process the on-line tax payments for Meade County taxpayers. Gov Tech Services charge the taxpayer a transaction processing fee for their service: For e-checks, $1.50. For credit or debit cards, 2.65% or minimum charge of $2.95.

Information:

When using an e-check as payment, you authorize a one-time electronic fund transfer from your account. Funds may be withdrawn from your account the same day we receive your payment. You will not receive a check back from your financial institution.

If your taxes are delinquent, you will not be able to pay online. Please call the Treasurer's Office at (605) 347.5871.

Payments over $99,999.00 cannot be accepted on-line.

Please note: The data in this application is as currently available on Meade County's system. Payments made through this web site may take a minimum of five business days to process and be reflected on this website. The user acknowledges and accepts the limitations of the data, including the fact that the data is dynamic and is in a constant state of maintenance and update.

For questions, please call the Meade County Treasurer’s Office at: 605-347-5871 / Monday - Friday: 8AM-5PM

ELDERLY & DISABLED ASSESSMENT FREEZE (Application - Fillable Form)

This program reduces the current assessed value of the homeowner's property by freezing the assessed value of the home to the qualifying year of the applicant. Property is defined as the house, a garage and the lot upon which it sits or one acre, whichever is less. Download the application or obtain an application from the Treasurer's Office. The application must be return to the Treasurer's Office on or before April 1 of each year. (SDCL 10-6A)

This Application needs to be applied for between January and April 1st every year

The Treasurer’s Office is responsible for collecting all taxes for the county, including: Real Estate, Mobile Home, and Special Assessments.

We assist the disabled and senior citizens to see if they qualify for a tax freeze, which freezes the assessed value of their home. This needs to be applied for between January and April 1st of every year. (Application)

There is also a sales and property tax refund program the state provides that we can help with. (Applications accepted from May 1st to July 1st.) There are income and other guidelines that must be met for the freeze and refund.

We handle all title transfers and renew licenses on new and used motor vehicles and boats (except for pro-rate vehicles). We now handle all lien notations, releases, and duplicate titles on motor vehicles. You can get forms by clicking on "Forms" under Treasurer and then to the appropriate form or at the South Dakota Department of Motor Vehicles website.

We can also issue temporary and permanent portable handicap permits for disabled persons.

The Treasurer receives and accounts for all County funds and is responsible for managing the County's investments. In addition, the Treasurer is responsible for submitting monthly remittance payments to the State as required by law. The Treasurer will issue distress warrants on behalf of the Department of Revenue and Department of Labor as required by law.

We issue kennel licenses for all kennels in the county (kennels will need to be inspected).

Taxes

The Treasurer’s Office is responsible for collecting all taxes for the county, including: Real Estate, Mobile Home, and Special Assessments.

Beginning March 23rd, 2022, Taxes can be paid online here: Pay My Property Taxes Online. Additionally, there is a phone number to call: 605-702-5020 that can take automated property tax payments over the phone.

Notices are mailed to owners in January. The first half is due on or before April 30th and the second half is due on or before October 31st. Real Estate taxes are paid in arrears. Example: in the year 2009 you will be paying on the 2008 taxes. All special assessments and all taxes less than $50.00 will be due on or before April 30th. In December there is a tax certificate sale on the property. We do accept payments that are postmarked for the April and October deadline. We would appreciate if when mailing your payments that you include a phone number or contact information.

We also can assist senior citizens or disabled persons to see if they qualify for a tax freeze. This will freeze the assessed value of their property. This will need to be applied for between January and April 1st of each year. There is also a Sales and property tax refund program the state provides for senior and disabled person. The applications are accepted from May 1st to July 1st. There are income and other guidelines for each of these forms. For information regarding either of these programs please call our office (605) 347-5871. To get the qualifications or to download the form, go here: Forms.

Tax Certificates

*Total dollars owed does not include interest and costs

SDCL 10-23-2. Publication or posting of notice of sale of tax certificate--Reconciliation of published list to tax list. The treasurer shall give notice of the sale of the tax certificate by publication of the sale once during the week before the sale in the official newspapers of the county. If there is no newspaper published in the county, the treasurer shall give notice by written or printed notice posted at the door of the courthouse for two weeks before the sale. The county auditor shall reconcile the published list of unpaid taxes to the unpaid taxes in the tax list.

SDCL 10-23-28. Sale of tax certificate by county--Price--Tax receipt issued--Rights acquired by purchaser. If any person intends to purchase the interest of the county in the tax certificate acquired by the treasurer for the county, the person may pay to the treasurer the amount of the taxes, penalty, interest, and costs of sale and transfer and all unpaid or subsequent taxes as specified in § 10-23-27. The treasurer shall issue a tax receipt for the taxes, penalty, interest, and costs. The treasurer shall assign and deliver to the purchaser the tax certificate of purchase held by the county for the real property, which assignment and transfer shall convey unto the purchaser all the rights of the county in the tax certificate as much as if the person was the original purchaser at the tax certificate sale.

Current Tax Certificates held by the Treasurer

General Questions:

When will my tax notice be mailed?

We mail tax notices to the property owner via the US Postal Service in the latter part of January. We only mail notices once per year, and the tax bill includes both halves of taxes due.

When are my taxes due?

Taxes in South Dakota are due and payable the first of January. However, the first half of the property tax payments are accepted until April 30th without penalty. The second half of taxes will be accepted until October 31st without penalty.

Can I make partial payments towards my taxes?

We do not accept partial payments for taxes due. We also do not accept payment plans.

When do taxes become delinquent?

Taxes become delinquent May 1st and November 1st.

What if I miss the tax due deadline?

There is a 10% annual penalty for late payments. Please keep in mind, that taxes that are not postmarked by April 30th and October 31st, respectively are also considered delinquent. If you mail your payment on time, and the post office fails to postmark it by those dates, it will be considered a late payment.

What methods are available for payment?

Beginning March 23rd, 2022, Taxes can be paid online here: Pay My Property Taxes Online.

There is a phone number to call: 605-702-5020 that can take automated property tax payments over the phone.

You can pay your taxes by mail. (Real estate tax payments can be mailed to the Meade County Treasurer -1300 Sherman Street, Sturgis SD 57785.) If paying by mail, the payment for the first half must be postmarked before April 30th, and the second half must be postmarked before October 31st. Payments postmarked after the deadline will be subject to penalties and interest, per SDCL 10-21-23 & 10-21-25.

In person at our office.

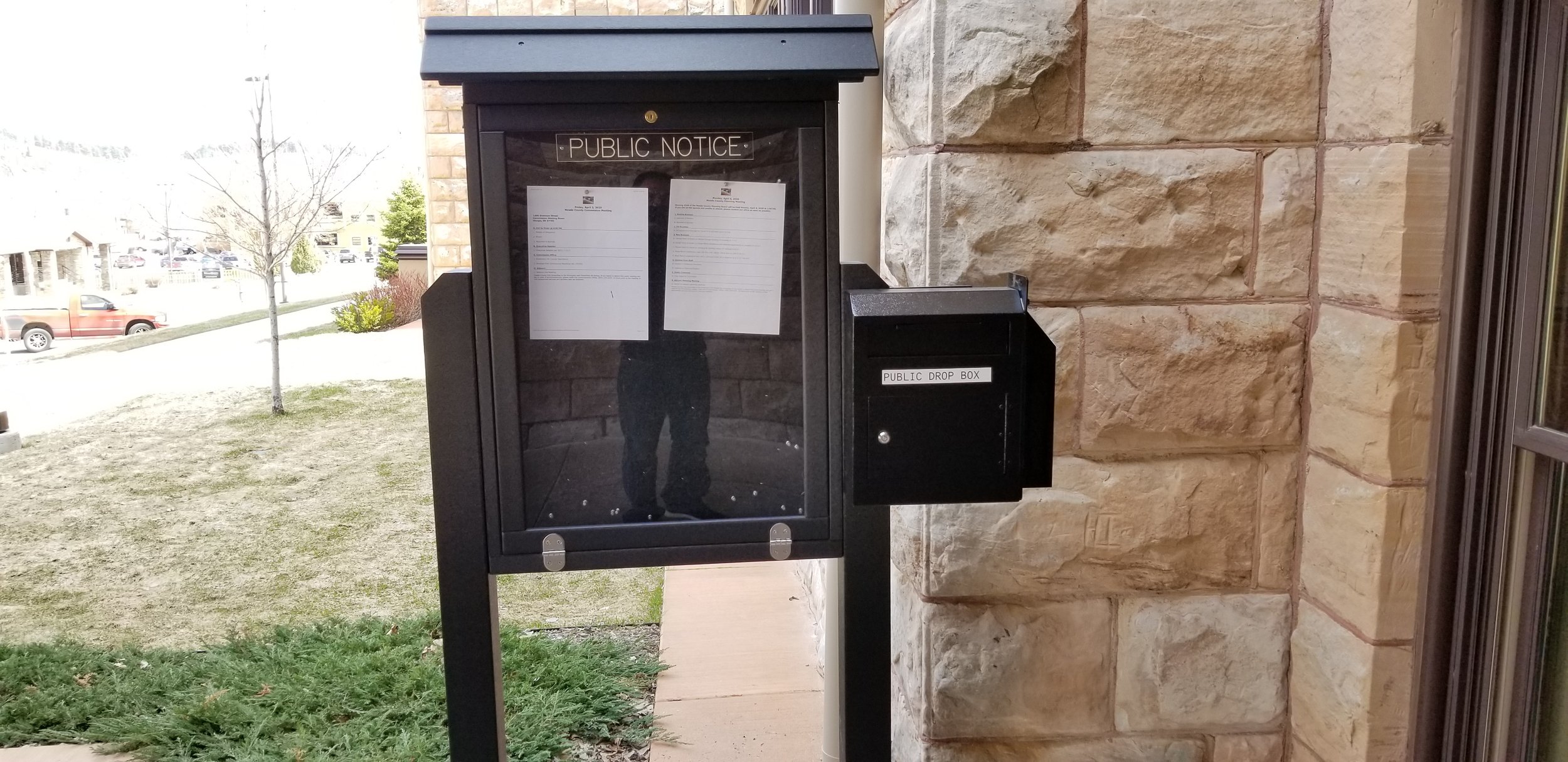

Use our drop box. (Pictured below, payment drop box is accessible 24/7 outside the County Administration Building located at 1300 Sherman Street, Sturgis, SD 57785.)

What information do I need when making my tax payment by mail?

It would be helpful if you would send us the stub from your tax statement. However, if that has been misplaced, please include an address, parcel # or bill # of the property you wish to pay or your payment will be returned.

What happens if April 30th or October 31st fall on a Saturday, Sunday, or Holiday?

According to state law, if the tax due date falls on a Saturday, Sunday or holiday, it is your responsibility to get your payment to our office by the last working day of the month.

If I’m moving my mobile home, what taxes must be paid upfront?

Upon getting your moving permit from the Treasurer’s Office, you will be required to pay current taxes and advance taxes. If moved after November 1st, additional taxes will be required.

How do I get Owner Occupied Status?

For the most accurate information regarding owner occupancy, please contact the Equalization Office at 605-347-3818.

Where can I find information about the assessed value of my property?

The county assessor is responsible for the appraisal and assessment of property. For the most accurate information regarding your assessment, please contact the Equalization Office at 605-347-3818.

According to state law, the County Assessor is responsible for the appraisal and assessment of property. The Treasurer's Office is responsible for billing and collection of taxes based on assessments. The Treasurer's Office has no authority over the amount of assessment, nor can they be involved in the appraisal process.

Are my tax records public information?

All real estate property taxes are public record and are available to anyone who inquires.

Are there tax reductions available for senior citizens or disabled persons?

We also can assist senior citizens or disabled persons to see if they qualify for a tax freeze. This will freeze the assessed value of their property. This will need to be applied for between January and April 1st of each year. There is also a Sales and property tax refund program the state provides for senior and disabled person. The applications are accepted from May 1st to July 1st. There are income and other guidelines for each of these forms. For information regarding either of these programs please call our office (605) 347-5871. To get the qualifications or to download the form, go here: Forms.

Am I eligible for the paraplegic veteran property tax reduction program?

This program exempts the property from all property taxes with the exception of special assessments. Obtain an application form from the Department of Equalization/Planning. The application is due on or before November 1st (SDCL 10-4-24.9 & 10-4-24.10) and must be submitted to the Department of Equalization/Planning.

Eligibility:

Are you paraplegic or an individual with the loss or loss of use of both lower extremities?

Is your home specifically designed as a wheelchair home?

Did you own and occupy your home during the entire previous year?

Are you the un-remarried widow or widower of a qualified veteran?

Verification is required to be completed by a medical doctor and the County Veteran Services Officer.

Am I eligible for a property tax exemption for disabled veterans?

This program exempts up to $150,000 of the assessed value for qualifying property. (The property subject to this exemption is the same property eligible for the owner-occupied classification.) Obtain an application form from the Department of Equalization/Planning. The application is due on or before November 1st (SDCL 10-4-40 & 10-4-41) and must be submitted to the Department of Equalization/Planning.

Am I eligible for the paraplegic property tax reduction program?

This program reduces property taxes on a graduated scale based on income. Property is defined as the house, a garage and the lot upon which it sits or one acre, whichever is less. Obtain an application form from the Department of Equalization/Planning. The application is due annually on or before January 1 (SDCL 10-4-24.11, 10-4-24.12, 10-4-24.13) and must be submitted to the Department of Equalization/Planning.

Eligibility:

Are you a paraplegic or an individual with the loss or loss of use of both lower extremities?

Is your home specifically designed as a wheelchair home?

Did you own and occupy your home during the entire previous year?

Do you live alone and have a yearly income under $14,671 OR do you live in a household whose members' combined income is under $18,731?

Links